Review Pacific Drive 2025 Aksi Unik & Suasana Mencekam Pacific Drive telah menjadi salah satu game survival yang banyak dibicarakan sejak perilisannya. Game ini […]

Strategi Chivalry 2 Cara Menjadi Ksatria Tak Terkalahkan

Strategi Chivalry 2 Cara Menjadi Ksatria Tak Terkalahkan Chivalry 2 menawarkan pengalaman bertempur yang epik, mengajak pemain untuk terlibat dalam pertempuran besar abad pertengahan. […]

Destiny 2 Sang Guardian Menyelamatkan Alam Semesta

Destiny 2 Sang Guardian Menyelamatkan Alam Semesta Destiny 2 adalah sebuah permainan yang menggabungkan genre first-person shooter (FPS) dan elemen role-playing game (RPG) dengan […]

Menara, Strategi, dan Kecepatan: Tantangan di Dunia Tower Dominion

Menara, Strategi, dan Kecepatan: Menaklukkan Tantangan di Dunia Tower Dominion Di antara banyak genre game strategi, tower defense tetap menjadi salah satu yang paling adiktif. […]

Bagaimana Hearts of Iron IV Membawa Perang Dunia ke Meja Anda

Strategi Dominasi Global: Bagaimana Hearts of Iron IV Membawa Perang Dunia ke Meja Anda Dalam dunia game strategi berbasis sejarah, hanya sedikit judul yang bisa […]

Mengubah Reruntuhan Menjadi Peradaban: di Game Captain of Industry

Mengubah Reruntuhan Menjadi Peradaban: Strategi Mendalam di Game Captain of Industry Bagaimana rasanya memimpin sebuah komunitas kecil yang terdampar di pulau kosong dan membangun peradaban […]

Devil May Cry Saat Iblis dan Gaya Bertarung Satu Paket Keren

Devil May Cry Saat Iblis dan Gaya Bertarung Satu Paket Keren Ketika dunia game Devil May Cry mulai jenuh dengan mekanisme aksi yang itu-itu […]

Resident Evil Code Veronica Terjebak di Pulau Kematian

Resident Evil Code Veronica Terjebak di Pulau Kematian Dalam dunia game bertema survival horror, Code Veronica menjadi salah satu babak penting yang menggambarkan betapa […]

Persona 4 Misteri, Persahabatan, dan Dunia TV Menegangkan

Persona 4 Misteri, Persahabatan, dan Dunia TV Menegangkan Di antara deretan game JRPG klasik yang legendaris, Persona 4 menjadi salah satu judul yang paling […]

Last Epoch: Menyusun Takdir di Dunia Eterra

Last Epoch merupakan ARPG modern yang menggabungkan konsep perjalanan waktu, build karakter fleksibel, dan crafting sistem inovatif di dunia fantasi Eterra. Eleventh Hour Games merancang […]

Prince of Persia The Thrones Penutup Epik dari Trilogi Legendaris

Prince of Persia The Thrones Penutup Epik dari Trilogi Legendaris Di antara sekian banyak game aksi-petualangan Prince of Persia yang pernah dirilis […]

Eksperimen Gila Iluminados di Resident Evil 4 Mutasi Mengerikan

Eksperimen Gila Iluminados di Resident Evil 4 Mutasi Mengerikan Kegelapan yang menyelimuti dunia fiksi tidak selalu berasal dari monster buas atau makhluk mitos. Resident […]

Rahasia di TimeSplitters yang Mungkin Belum Kamu Ketahui

Rahasia di TimeSplitters yang Mungkin Belum Kamu Ketahui Game FPS klasik memiliki daya tarik tersendiri yang sering kali membuat para pemainnya TimeSplitters bernostalgia. Salah […]

Misteri Shadow of the Colossus Kisah Wander Penuh Duka

Misteri Shadow of the Colossus Kisah Wander Penuh Duka Beberapa game Shadow of the Colossus tidak hanya menghadirkan petualangan dan aksi yang mendebarkan, tetapi […]

Mengapa Kamera Obscura Begitu Penting di Fatal Frame

Mengapa Kamera Obscura Begitu Penting di Fatal Frame Dalam dunia game Fatal Frame, senjata seperti pistol, pedang, atau bahkan kekuatan magis biasanya menjadi alat […]

Desa Berbahaya di Resident Evil 4: Leon dalam Labirin Ketakutan

Desa Berbahaya di Resident Evil 4: Leon dalam Labirin Ketakutan Resident Evil 4 merupakan salah satu game survival horror terbaik yang pernah dibuat oleh […]

Cara Bermain Crash Tag Team Racing agar Selalu Unggul

Cara Bermain Crash Tag Team Racing agar Selalu Unggul Crash Tag Team Racing adalah salah satu game balapan arcade yang paling seru dan penuh aksi […]

Skill Counter dan Parry Wajib Pemain Tekken 4

Skill Counter dan Parry Wajib Pemain Tekken 4 Dalam dunia game fighting, Tekken 4 menjadi salah satu seri yang menghadirkan mekanisme pertarungan yang lebih realistis […]

Rahasia Menjadi Juara dengan Sepeda Terbaik di Game Downhill

Rahasia Menjadi Juara dengan Sepeda Terbaik di Game Downhill Game downhill menawarkan pengalaman bersepeda yang menegangkan dengan kecepatan tinggi, jalur ekstrem, dan rintangan yang menantang. […]

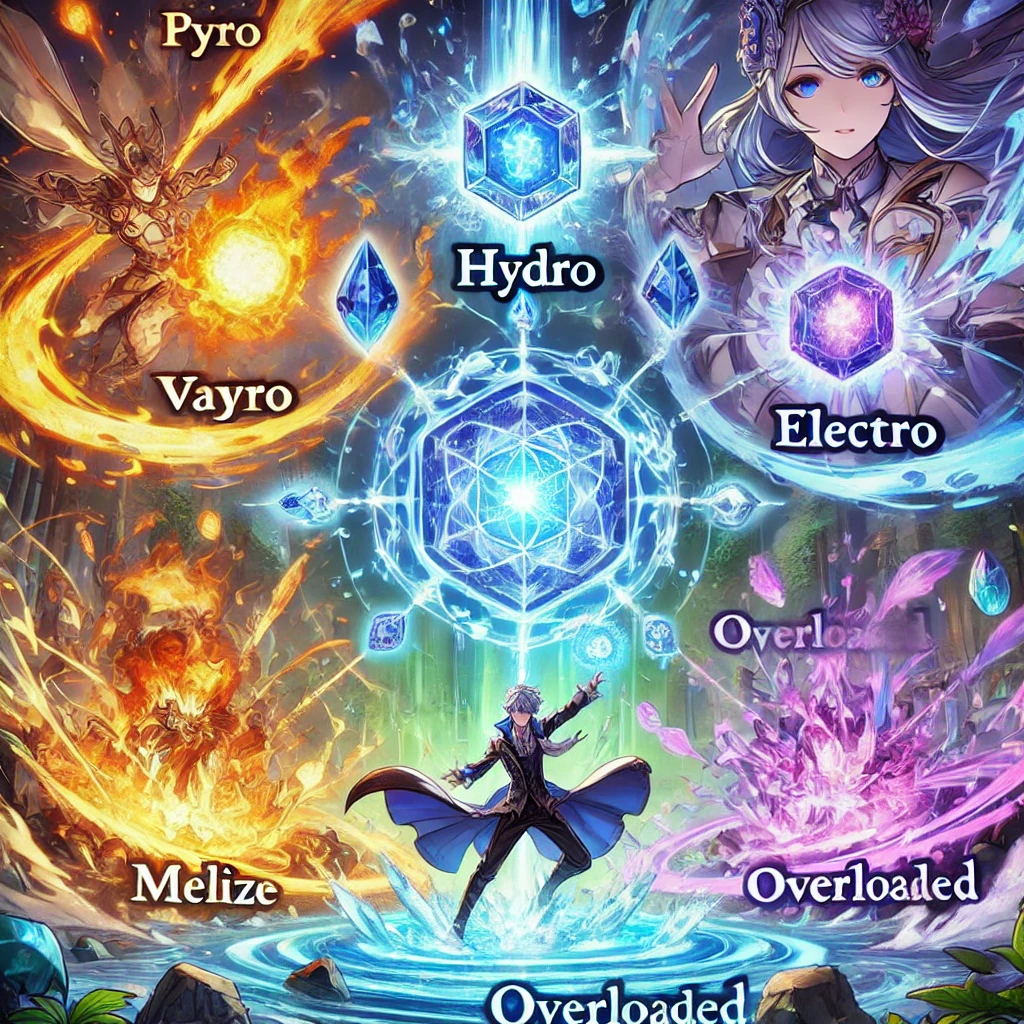

Tips dan Trik Elemental Reaction di Genshin Impact

Tips dan Trik Elemental Reaction di Genshin Impact Genshin Impact adalah game RPG open-world yang memanfaatkan sistem elemen sebagai inti dari mekanik pertarungan. Salah satu […]

Preman Rampas Uang Bocah Penjual Air Mineral, Simak Kronologinya

Preman Rampas Uang Bocah Penjual Air Mineral, Simak Kronologinya Kasus memilukan terjadi di sebuah kota di Indonesia ketika dua preman merampas uang hasil berjualan seorang […]

Cuaca Ekstrem, Trump Pindahkan Pelantikan ke Lokasi Indoor

Cuaca Ekstrem, Trump Pindahkan Pelantikan ke Lokasi Indoor Pelantikan Donald Trump kembali menjadi sorotan publik, kali ini karena keputusan yang diambil untuk memindahkan casino88 login lokasi […]

Berapa Lama Kue Keranjang Bisa Bertahan? Ini Penjelasannya

Berapa Lama Kue Keranjang Bisa Bertahan? Ini Penjelasannya Kue keranjang adalah salah satu makanan khas yang selalu hadir saat perayaan Imlek. Selain rasanya togelin yang manis […]

Makna Mendalam di Balik Kue Keranjang Sebagai Simbol Imlek

Makna Mendalam di Balik Kue Keranjang Sebagai Simbol Imlek Kue keranjang, atau dalam bahasa Mandarin dikenal sebagai nian gao, adalah salah satu hidangan khas yang […]

WhatsApp Tambahkan Fitur Transkrip Pesan Suara, Apa Keunggulannya?

WhatsApp Tambahkan Fitur Transkrip Pesan Suara, Apa Keunggulannya? WhatsApp, aplikasi perpesanan paling populer di dunia, kembali menghadirkan inovasi baru. Kini, pengguna dapat menikmati fitur transkrip […]

Memahami Cerita di The Legend of Zelda Breath of the Wild

Memahami Cerita di The Legend of Zelda Breath of the Wild The Legend of Zelda: Breath of the Wild adalah salah satu game paling […]

Daftar Kendaraan Kencang untuk Asphalt Legends

Daftar Kendaraan Kencang untuk Asphalt Legends Asphalt Legends, salah satu game balap paling populer di dunia, menawarkan pengalaman adrenalin tinggi dengan koleksi mobil-mobil luar biasa. […]

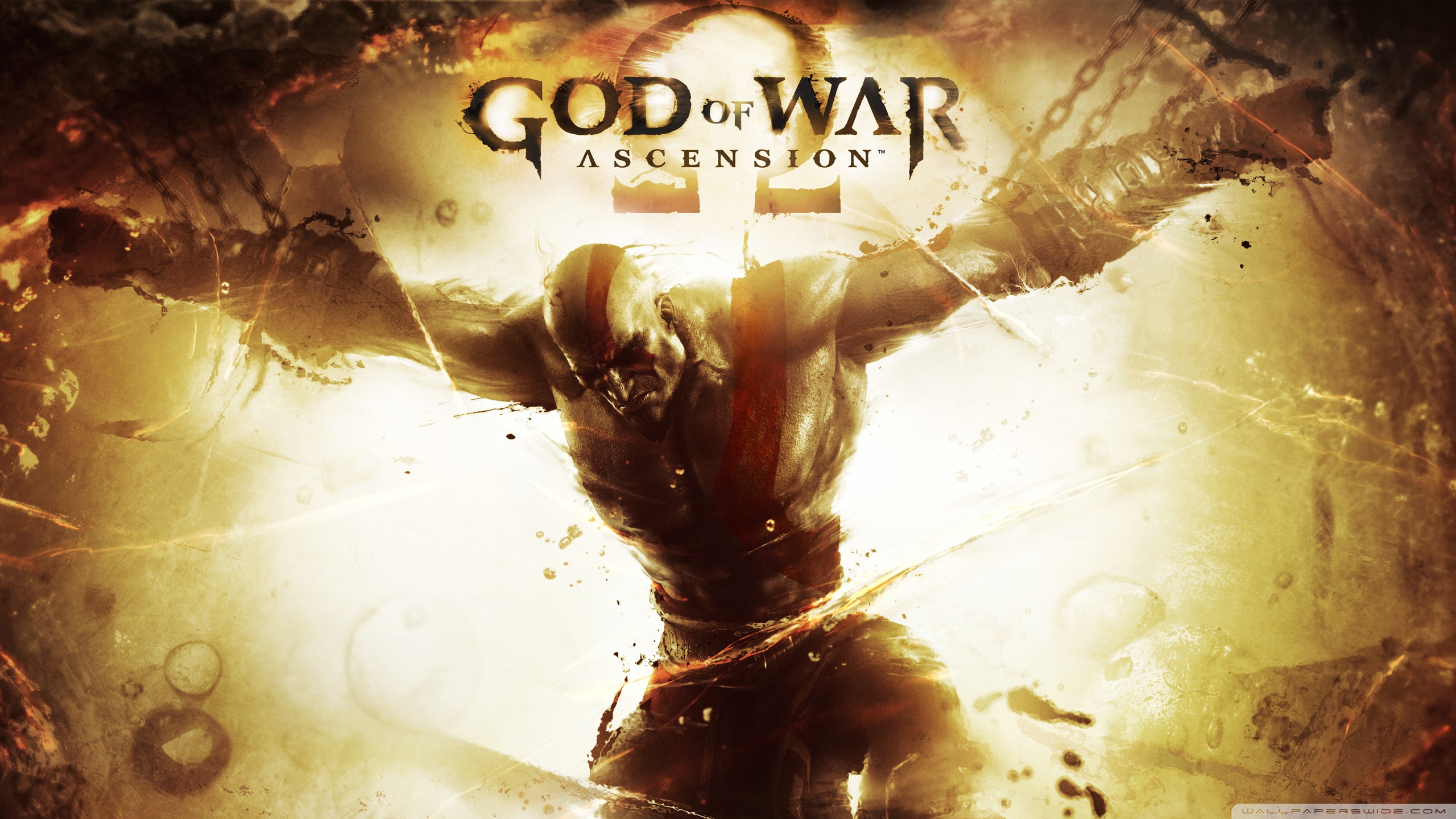

Review Game God of War: Ascension – Awal Kisah Sang Dewa Perang

Review Game God of War: Ascension – Awal Kisah Sang Dewa Perang God of War: Ascension, yang dirilis pada tahun 2013 untuk PlayStation 3, adalah […]

Review Game Call of Duty: Modern Warfare 3 – Klimaks dari Perang Epik

Review Game Call of Duty: Modern Warfare 3 – Klimaks dari Perang Epik Call of Duty: Modern Warfare 3 (MW3), yang dirilis pada November 2011, […]

Review Game Harvest Moon: Back to Nature – Keajaiban Simulasi Kehidupan di PS1

Review Game Harvest Moon: Back to Nature – Keajaiban Simulasi Kehidupan di PS1 Harvest Moon: Back to Nature adalah salah satu game legendaris di era […]

Review Game Suikoden 5: Kembali ke Akar Seri dengan Cerita yang Epik

Review Game Suikoden 5: Kembali ke Akar Seri dengan Cerita yang Epik Suikoden 5, yang dirilis pada tahun 2006 untuk PlayStation 2, adalah upaya Konami […]

Review Game Suikoden 4: Petualangan di Lautan yang Memecah Pendapat

Review Game Suikoden 4: Petualangan di Lautan yang Memecah Pendapat Suikoden 4, yang dirilis pada tahun 2004 untuk PlayStation 2, adalah entri keempat dalam seri […]

Review Game Suikoden 3: Evolusi Epik dalam Dunia RPG

Review Game Suikoden 3: Evolusi Epik dalam Dunia RPG Suikoden 3, yang dirilis pada tahun 2002 untuk PlayStation 2, adalah lanjutan dari seri Suikoden yang […]

Review Game Suikoden 2 PSX: Mahakarya RPG dengan Cerita dan Emosi Mendalam

Review Game Suikoden 2 PSX: Mahakarya RPG dengan Cerita dan Emosi Mendalam Suikoden 2 adalah salah satu RPG terbaik sepanjang masa yang dirilis untuk PlayStation […]

Review Game Suikoden 1 PSX: Awal Sebuah Legenda RPG yang Tak Lekang oleh Waktu

Review Game Suikoden 1 PSX: Awal Sebuah Legenda RPG yang Tak Lekang oleh Waktu Suikoden 1 untuk PlayStation (PSX) adalah salah satu game RPG yang […]